Skybound Wealth Portfolios. Designed for Times Like These

This is a div block with a Webflow interaction that will be triggered when the heading is in the view.

It wasn’t long ago that we published our most recent Quarterly Market Update, but even since then there’s been a lot happening in both the markets and in the world in general. Inflation remains stubbornly high, central banks have hiked interest rates and signalled more to come, strict lockdowns in China are disrupting global trade, and Russia’s invasion of Ukraine continues along with its impact on global energy and food prices.

In this update we’ll cover all of these events, the impact on the markets, what could be in store if things continue to take a turn for the worse, and what we think investors should be doing about it.

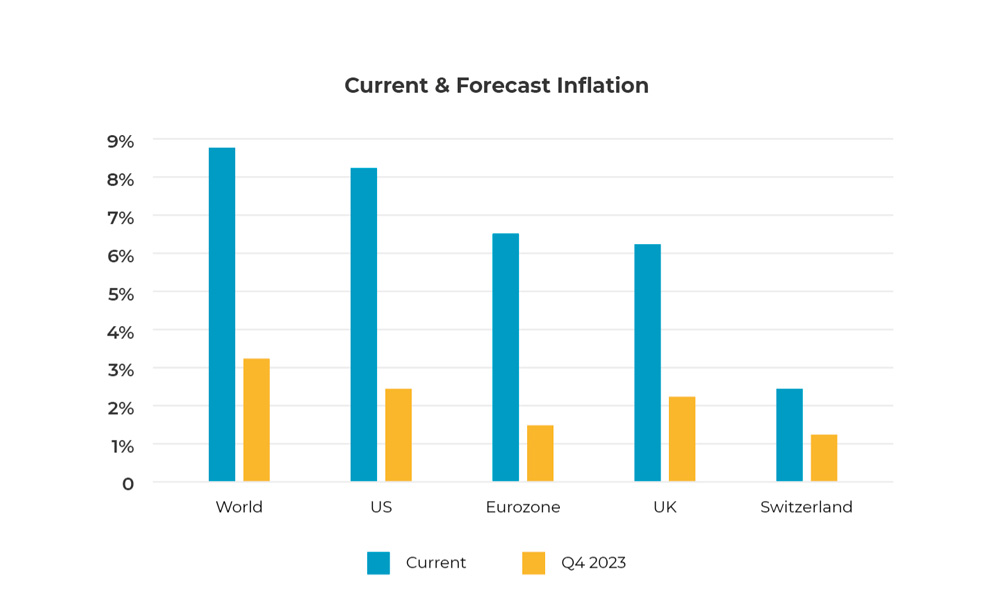

You probably don’t need us to tell you inflation is continuing to rise. Not only is it widely reported in the media, but you’ve likely also felt it first-hand with rising food and energy bills. According to the OECD (Organisation for Economic Co-operation and Development) the latest global annual inflation figure (April 2022) stands at 8.8%. Food inflation is slightly higher at 10%, while energy inflation is an eye-watering 33.7%.

It’s perhaps no surprise that energy inflation is even higher in the Eurozone with prices a staggering 44.4% more than they were a year ago. Even the relatively energy-independent USA has seen its energy prices jump by 32%. Overall though, inflation in much of the developed world is lower than the global average – 8.5% in the USA, 7.4% in the Eurozone, 6.2% in the UK, while in Switzerland it’s as low as 2.6%, and only 1.2% in Japan.

Although high inflation is currently causing a lot of discomfort to both household budgets and markets alike, it may turn out to be fairly short-lived. By the end of 2022, the OECD forecasts global inflation to drop to 3.4%, and to 3.1% by the end of 2023. So still higher than the 2% average we’ve been used to over the past decade, but significantly less than current levels. Developed nations’ inflation, however, is predicted to settle closer to those lower long-term averages by the end of next year, with figures of 2.5% for the USA, 2.3% in the UK, and 1.8% in the Eurozone.

So while things may remain uncomfortable for a while, current levels of inflation may turn out to be a short-term phenomenon. That’s because central banks such as the US Federal Reserve (the Fed) and the Bank of England are tasked with controlling inflation. They’ve already been putting their main tool they use to keep it in check to work – interest rates.

Whenever there’s runaway inflation, interest rates are usually the main means to deal with it. There are a number of things that can cause inflation, such as surging consumer and business demand, rising commodity prices, restricted supplies of goods and climbing wages (we’ve had all of them recently). In response, central banks can put up interest rates, which makes borrowing more expensive, encouraging consumers and businesses to spend and invest less. This lets steam out of the economy and usually results in inflation falling back.

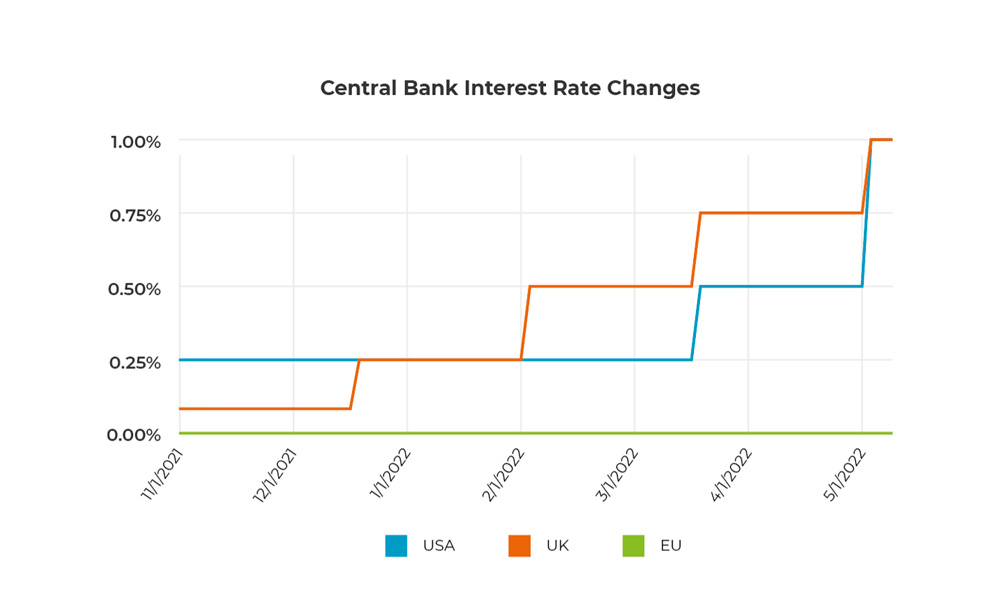

Many economists have complained that central banks such as the Fed have been too slow to act to rein in inflation. Central banks have a delicate balancing act though, between keeping inflation under control and not damaging the economy too much. The Fed seems to have jumped into action, however, with March seeing the USA’s first interest rate increase since 2018 from 0.25% to 0.5%. Then on 4 May they increased the rate again to 1%, which may not seem like much, but this represents the biggest interest rate hike in the US for 22 years.

The Bank of England has been even busier, putting up rates four times in quick succession between December 2021 and May 2022. The base rate also now stands at 1%, up from 0.1% before the hikes. The European Central Bank (ECB), on the other hand, has held off for now and maintains its stance of keeping the interest rate at zero. They are under increasing pressure, however, and some predict the ECB will be forced to act by the middle of the year, when the Fed is also expected to hike rates again.

What does all this mean for markets though? Unfortunately, markets don’t like it when interest rates rise. It makes companies’ debt more expensive, means they often invest less, and consumers tend to buy fewer of their products and services. Bonds also tend to fall when interest rates go up, although yields also rise, so from an income perspective they can become more attractive.

It’s important to remember though, that like inflation, interest rates won’t keep going up forever. They’ll eventually plateau and could fall back down again. The pace and extent of this though is heavily dependent on how well central banks do in combatting inflation.

Wars are perhaps even more unpredictable than economies and markets. Although some may have seen inflation coming after unprecedented levels of government financial stimulus during the pandemic, and subsequent interest rate rises in response, few would have foreseen a military invasion within Europe.

Outside of the conflict itself, the biggest economic impact has mainly been the well-publicised pressure on food and energy prices. Russia is the largest natural gas exporter in the world, and the second largest oil exporter. Combined, Ukraine and Russia also account for around a quarter of the world’s wheat and a fifth of the global supply of corn.

From an economic and markets point of view, however, Russia is not a top-ten economy and only made up around 0.3% of the global stock market before the invasion of Ukraine. That means the sanctions imposed on Russia by western countries may not have much of a spill over effect, and the major economic impact of the invasion could be limited to stoking energy and food inflation, which were already on the rise before the invasion.

While many of us have more-or-less returned to life as it was before the pandemic, China continues to follow its strict zero-covid policy. Around half of China’s 100 largest cities, including Beijing and Shanghai, have been under curbs recently. It’s estimated this has affected over 300 million people in provinces accounting for 80% of China’s economy.

Freight has been limited, ports have been closed, Chinese consumer demand has weakened, and exports have been hit hard. As the second largest economy and the biggest exporter on the planet, this has undoubtedly had a knock-on effect both inside and outside the country.

Last year China was by far the worst performing of the major stock markets, and that position hasn’t changed this year. While the Chinese government probably doesn’t pay too much attention to its stock markets, it is likely to be keeping a close eye on the economic impact of its lockdown policy. Whether it will soften its stance, or perhaps even double down if case numbers rise, remains to be seen. The sooner China resumes ‘normal service’ though, the better for global trade.

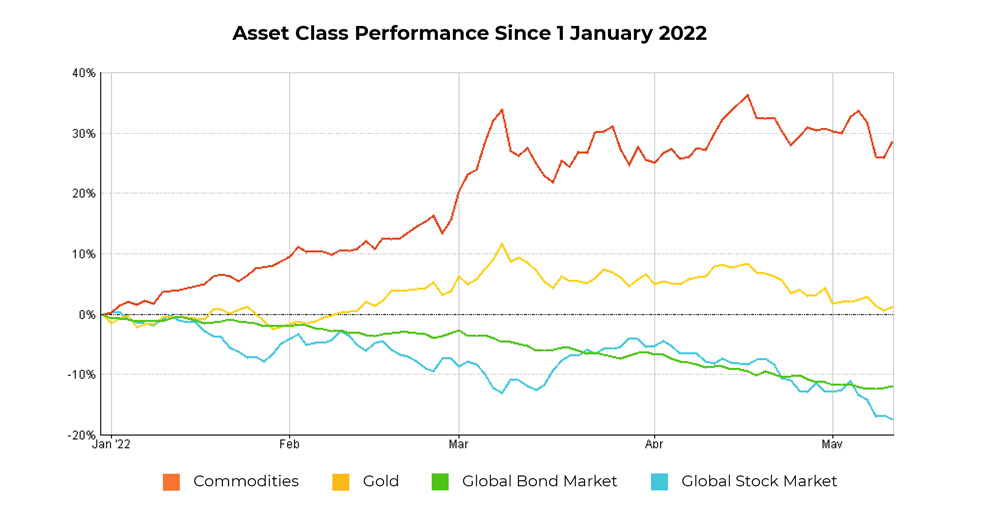

With all that’s been going on it won’t come as a surprise that markets have been spooked. Not only are current events generally bad news for them, but there’s a lot of uncertainty around what happens next. Since the global stock market peaked on 4 January 2022, it’s fallen 17.2%. While that doesn’t make pleasant reading it means we’ve not entered ‘bear market’ territory, which is generally accepted to be a fall of 20% or more.

The Europe ex-UK and Chinese stock markets, however, are both there with declines of 21.6% and 23.9%, respectively. Others markets such as the UK and Pacific ex-Japan on the other hand, have held up much better and have limited their drops to single digits percentages. The biggest stock market in the world, the US, fell broadly in line with the global market with a 17.3% decline.

While they haven’t fallen to the same extent as equities, as is normally the case, it’s been a disappointing period for bonds too. Since the beginning of the year the global bond market has dropped 12.1%. This is an unusually large fall for bonds, but isn’t unexpected given bonds tend to fall when interest rates rise, and there have been plenty of upwards shifts in rates lately.

There has been one major type of asset, however, that’s benefitted amongst all the recent turmoil – commodities. Commodities are broadly made up of three categories – metals, energy and agriculture. Their performance is largely driven by the rise and fall of their prices. As prices have risen recently, so have commodity returns. Since the start of the year they’ve leaped 25.9%, largely driven by rocketing energy prices. These returns are unlikely to repeated over the long term though, and it’s important to remember commodities can be an extremely volatile asset class.

Gold, which is itself a precious metal commodity, has held up well and risen 1.2% since the start of the year. While that’s a long way off the gains of broader commodities, compared to the recent misfortunes of equities and bonds, gold has provided good portfolio protection as it often does during crisis periods.

Although this won’t be the answer you’re looking for, unfortunately no-one really knows what’s in store. Although forecasts expect more interest rate rises this year and inflation to subside next year, it’s important to remember forecasts can be and often are wide of the mark. Listen to enough different predictions and some of them will turn out to be correct, but even the most compelling arguments, made by the brightest people working for the biggest, best-resourced firms can still be plain wrong.

While there’s no doubt that high inflation and rising interest rates aren’t favourable environments for markets to thrive, it’s also important to remember that markets are resilient. They are not same thing as the economy, and they reflect the future rather than the present. So while the short-term outlook isn’t rosy, markets could still deliver positive returns. Even if the global economy stutters, markets could have factored this in already and rise, like they did in 2009 (then the worse year for the global economy since the 1920s yet the global stock market rose 34.6%).

On the war in Ukraine, of course no-one outside the Kremlin knows how it will play out and it seems not even the Russian government had planned for a dragged-out conflict. Only the Chinese government knows whether their strictly-enforced lockdowns will continue, but not even they know whether virus cases will rise or fall.

As for the markets, anyone who claims to know what they’ll do over the coming months needs a healthy dose of humility. They could fall further and enter bear-market territory, but equally they could have already priced in all the bad news and begin to recover. While the near term is uncertain, what we do know though, is that for generations markets have gone up in more years than they’ve gone down, and we see no reason for that to change. Fortunately, it’s what happens over years – not weeks and months – that matters most to your investments.

There’s no denying that it’s currently a difficult period to be an investor. It’s during times like these though, that you really find out what kind of investor you are. Many times we’ll speak to people who say they’ll stay calm and focused on the long term during market volatility, but then when they actually experience it they do the exact opposite. Market falls are a perfectly normal part of investing, so if you’ve found yourself struggling with the ups and downs recently, you might want to consider the level of risk you’re taking.

It might also be tempting to ditch investments that have been poor performers recently and switch into things that have worked well. This could be a mistake though, as sometimes the best performers of recent months become the worst performers in the months ahead and vice versa. We think the best thing you can do is make sure your investments are well diversified across asset classes, regions, industries and styles in the first place. Then assuming your circumstances and risk tolerance allow it, stay focused on your investments’ long-term potential and don’t be tempted to tinker.

We’re sometimes asked what we’re doing to our portfolios in response to market volatility. The answer to that is we’re doing exactly the same as we do whether markets are going up, down or sideways. We’re not making knee-jerk reactions. We’re not trying to predict the unpredictable. Instead we’re sticking to our disciplined, long-term approach and making sure the portfolios are always in a good position for both pleasing and painful markets. That doesn’t mean they’ll be immune from falls, but it does mean we think over the long term they should benefit when markets rise and provide a measure of protection when they fall.

Over decades and decades, markets have shown us that those who are consistently rewarded are not those who try to be smarter than everyone else. Nor is it those who jump in and out of the markets in anticipation of rises and falls. The markets reward those who can take the rough with the smooth, who aren’t tempted to chop and change, and who can simply stay invested. We’ll back the long-term success of the markets over short-term troubles and forecasts any day of the week.

If you have any questions, contact your advisor today for further information.

Past performance is not a guide to future returns. Investment in securities involves the risk of loss and the advice herein cannot be construed as a guarantee that future performance will be reflective of past returns.

Ordered list

Unordered list

Ordered list

Unordered list