Josh Burton, CFO and Financial Advisor explains why those with UK ties should take stock of recent tax changes, key deadlines, and filing requirements.

This is a div block with a Webflow interaction that will be triggered when the heading is in the view.

If you’ve left the UK behind, your pension may not need to be taxed there. But that’s exactly what happens to many expats drawing income from UK pensions, often without them even realising it.

The fix? It’s called an NT (No Tax) Code, and it can mean the difference between building your retirement and losing up to 45% of it to emergency tax. Here’s everything you need to know.

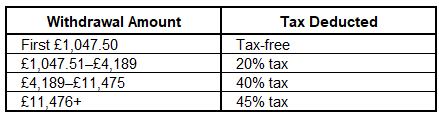

Many UK pension providers automatically apply PAYE (Pay As You Earn) tax, even if you live in Miami, Madrid, or Dubai. This often means tax is deducted at source using a generic emergency code, which can result in 20%, 40%, or even 45% being withheld unnecessarily. For example, if you withdraw £50,000 from your SIPP, you could lose over £20,000 straight away, simply because the system doesn’t know you’re a non-resident.

An NT (No Tax) Code tells HMRC: “This individual is no longer a UK tax resident and lives in a country with a tax treaty. Don’t deduct UK tax from their pension.” As a result, your pension gets paid out gross, no UK tax withheld, and you settle your tax affairs in your current country of residence.

You can apply for an NT code if you’re a non-UK tax resident under HMRC’s Statutory Residence Test, you receive UK pension income, whether from a SIPP, final salary, or defined contribution scheme, and you live in a country that has a Double Taxation Agreement covering pensions. Common countries include the USA, France, Spain, the UAE, Saudi Arabia, Oman, and many others.

UK pension schemes often use the standard 1257L Month 1 tax code, which works like this:

You then face the burden of completing a UK tax return, reclaiming the tax, and waiting months for repayment, every year.

First, confirm that you are genuinely non-resident under UK rules. HMRC will assess your days in the UK, ties to property, work, and family. Next, trigger a PAYE record by requesting a small pension payment, typically around £1,000, since HMRC cannot issue an NT code without an existing record. Then, complete the correct form. Most individuals use Form DT-Individual, which declares your foreign residency and UK pension income, though some countries have their own versions. All forms and country-specific variations can be found on the HMRC website.

You will also need to obtain local residency certification to prove that you are a tax resident in your new country. This usually means providing a Tax Residency Certificate from the relevant authority. Examples include a certificate from the Federal Tax Authority in the UAE, a certificate of tax residence from the French Tax Office, IRS Form 6166 in the United States, a Certificado de Residencia Fiscal in Spain, a certificate from the Zakat, Tax and Customs Authority in Saudi Arabia, or a certificate issued by the Tax Authority of Oman. If you’re unsure how to obtain this, check with your local tax office or its official website.

Once your forms and certification are ready, submit them to HMRC along with your pension details. Processing typically takes 12–16 weeks. Finally, confirm that your NT code is active, as HMRC sends it directly to your pension provider. Make sure it has been applied before taking your next pension withdrawal.

One common mistake expats make is applying too late. It’s important to do this before taking any significant income from your pension. If you wait, you risk having a large portion of your withdrawal taxed unnecessarily. Another mistake is missing documentation, particularly tax residency proof. Without this documentation, your application may be delayed or rejected.

Some expats also end up using the wrong form. While most individuals need to complete Form DT-Individual, some countries have bespoke versions of this form. Make sure to use the correct form for your country of residence.

Lastly, unclear residency can be a problem. HMRC may question situations where your residency status is borderline. Ensure that you meet the criteria to avoid delays in processing your application.

There are several types of pensions that can qualify for the NT code. SIPPs (Self-Invested Personal Pensions) are eligible, including income drawdown, UFPLS (Uncrystallised Funds Pension Lump Sum), and annuity-style withdrawals.

Workplace schemes also qualify, such as final salary pensions, AVCs (Additional Voluntary Contributions), and personal pensions. In some cases, your State Pension can qualify, depending on the Double Taxation Agreement (DTA) in place between the UK and your country of residence.

An NT code doesn’t mean “no tax ever.” It simply means that the UK will not tax your pension income. However, you still have tax obligations in your country of residence.

You will need to report your pension income in the country where you live. If applicable, you may also need to pay tax on it there. It’s essential to maintain good records of your pension income and any taxes paid to ensure compliance with your local tax laws.

A client recently moved to Dubai and took £70,000 from his SIPP. Without an NT code, he lost over £28,000 to emergency tax. We helped him reclaim it, and ensured all future withdrawals are paid gross, without delay. This is the kind of planning that makes a real difference.

The NT code process isn’t complicated, but it is slow. If you wait until after your withdrawal, the damage is done. At Skybound Wealth, we specialise in this process, especially for British expats in the Middle East and Europe, and the USA. We know the paperwork, the tax offices, the timelines, and how to get it right first time.

Need help applying for your NT code or reviewing your pension income strategy? Book a call with Skybound Wealth today.

With a career built on delivering the highest standards of financial advice and a passion for developing others to do the same, Tom Pewtress is a senior leader at Skybound Wealth Management. Known for his deep technical expertise and hands-on experience across global markets, Tom ensures both clients and advisers are equipped with the knowledge, tools, and strategies to succeed, no matter how complex the situation.

Ordered list

Unordered list

Ordered list

Unordered list