Drawing inspiration from Dickens' A Christmas Carol, Bryan Bann explores how you can enjoy the holidays now without sacrificing your future.

This is a div block with a Webflow interaction that will be triggered when the heading is in the view.

It’s not often a type of investment attracts as much attention as commodities have recently. Not only have they been one of the best performing asset classes lately, they’ve also been caught up in global politics and have been one of the driving forces behind your bills going up. Let’s look at what commodities are and explore whether or not they could make a good investment for your portfolio.

Commodities are the raw materials used to create products that businesses and consumers buy. They can be broadly split into three categories – energy, which is mainly oil and gas; metals, including industrial ones like copper and aluminium and precious metals such as gold and silver; and agriculture, which covers everything from coffee to cotton to cattle.

Like all investments, commodities have their pros and cons. They can offer portfolios additional diversification and the potential for long-term growth. Their returns are significantly driven by the rise and fall in their prices, which can be different to the ups and downs of the stock and bond markets. Commodities can also be viewed as a hedge against inflation, as they tend to rise with it – in fact increasing commodity prices are often the cause of inflation.

Compared to other types of investments though, such as bonds, commodities can be more volatile and at times can be even more volatile than the stock market. They may not perform well during downturns in the global economy, when consumer and industrial demand slows. They can also be heavily affected by politics (as we’re seeing right now with the Russia-Ukraine conflict pushing up oil, gas and wheat prices), regulations, and even weather.

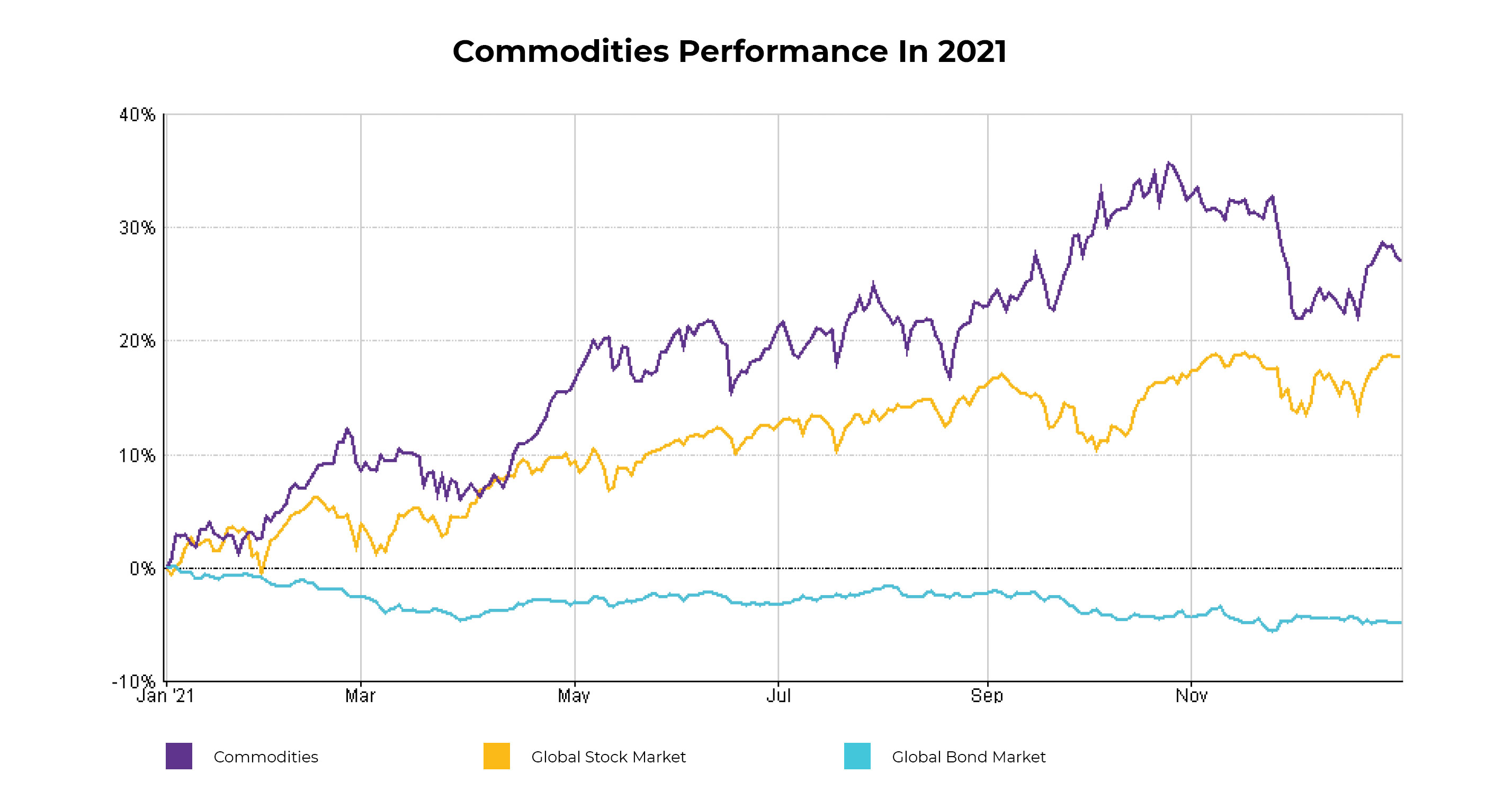

Commodities had a very strong 2021, beating all major traditional asset classes with a return of 27.1%. A combination of pent-up demand following the reopening of economies and continuing bottlenecks constraining supply has driven up many commodity prices, particularly oil, gas and many industrial metals.

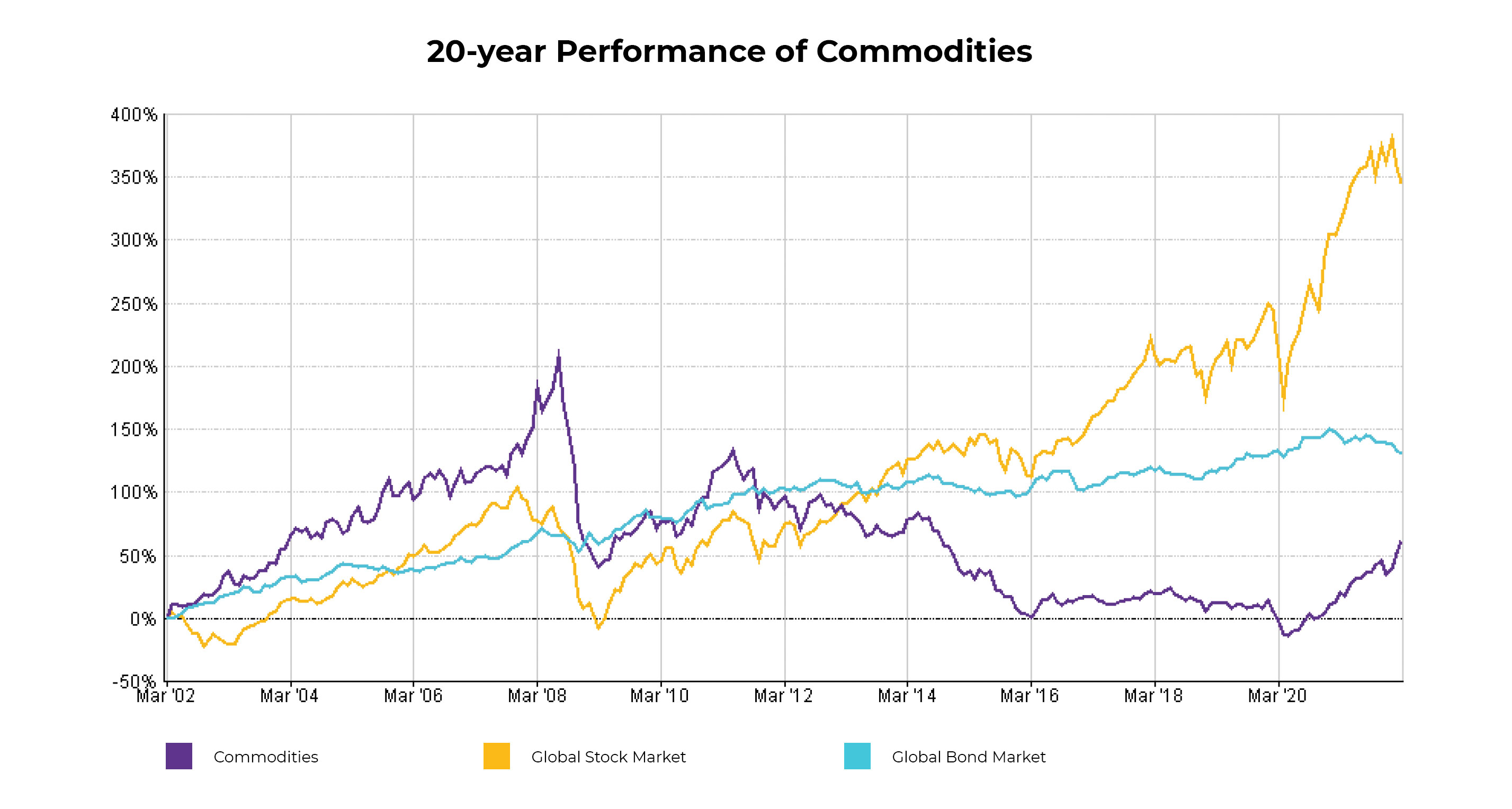

Over the longer term though, the performance of commodities has generally been poor. They not only delivered returns significantly below other major asset classes but posted negative returns over the past 15 years. On the other hand, if we are in for a lengthy period of inflation or, as some predict, we’re starting a new commodities ‘super cycle’ then they could be set to benefit.

For all but the biggest and wealthiest investors, you can’t actually invest directly in commodities. It’s very difficult and costly to take ownership of thousands of barrels of oil or warehouses full of farm produce, for example. That’s why most investment in commodities is done using derivatives.

Derivatives are artificially-created ‘synthetic’ investments that aim to mimic the performance of something. While derivatives can provide cost-effective and convenient exposure to otherwise hard-to-invest-in things like commodities, they are also higher-risk and can be complex.

In the case of commodities, the derivatives used are ‘futures contracts’, where one party agrees to buy the commodity at a set price on a given date in the future from another party. As most investors never actually want to take delivery of the commodity, they need to sell the existing contract just before it expires and enter into a new one. Due to the way most commodities are priced, the new contract is often more expensive than the old one, resulting in a ‘negative roll yield’, which reduces investors’ return.

While many will no doubt be enticed to invest in commodities after their recent returns, we’re always focused on long-term performance potential as well as risk. In our view, it’s very difficult to know what to expect from commodities over the long-term given the unpredictability of the things that influence them. We also think the level of risk taken investing in commodities has outweighed the returns they’ve delivered.

That’s why we don’t invest in broad commodities within our portfolios. We do like the inflation protection and diversification benefit offered by one type of commodity though – gold – which is why we have a small exposure to the yellow metal in our balanced and cautious portfolios.

We don’t rule out a strong run for broad commodities in the months and potentially years ahead, but for us other asset classes offer a better risk-return trade-off. If you’d like to learn more about the investments within our Growth or Responsible Growth portfolios, please contact your Skybound Advisor or nearest Skybound Wealth office.

Ordered list

Unordered list

Ordered list

Unordered list