This is a div block with a Webflow interaction that will be triggered when the heading is in the view.

Since the dawn of investing, bonds have formed a key part of balanced portfolios. In recent times though, things have changed. With interest rates on the rise, some investors have declared it’s the end of the road for bonds. In this article we’ll look at their pros and cons, the outlook for bonds and whether we think they still deserve a place in investment portfolios.

Bonds are typically seen as a lower-risk investment. Compared to the stock market, they jump around less so are used to dampen volatility within a portfolio. Bonds also tend to have a low correlation to equities, or in other words, they zig when equities zag. During 2020’s ‘covid crash’, when the global stock market fell over 33% in the space of a month, bonds barely noticed and slid only 3%. During 2008 the stock market fell more than 42% whereas bonds actually rose 5%.

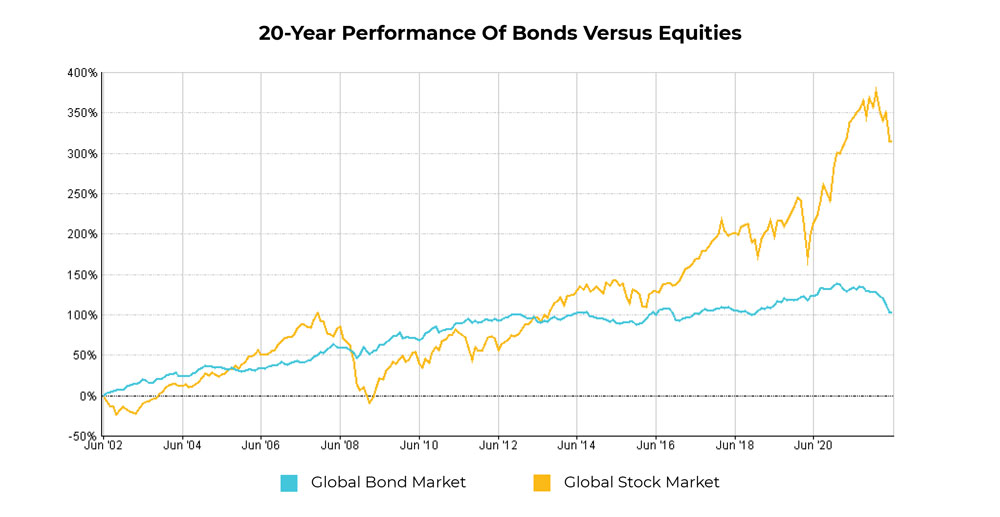

This has resulted in bonds providing much steadier returns than equities. While equities usually deliver bigger gains over the long term, bonds have been used by investors to smooth their overall portfolio performance. That doesn’t mean, however, that bonds don’t dip. On average, the global bond market has delivered negative returns one in every five years.

Bonds have also historically been used as way to generate income. In days gone by investors could rely on even the most secure (and therefore lowest yielding) bonds to deliver a healthy level of income. Bond yields are heavily tied to interest rates, so as interest rates have fallen over several decades, so too have bond yields.

While falling yields isn’t great news from an income perspective, it actually helped bond’s performance. That’s because bond yields and prices move in opposite directions. So as yields fell, prices rose and the performance of bonds was boosted.

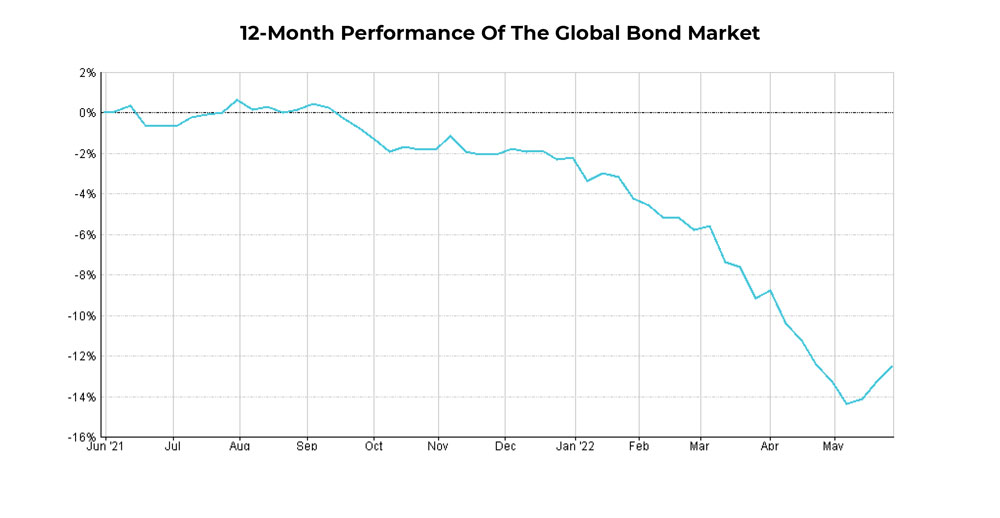

Now though interest rates are on the rise. The Bank of England increased rates to the highest level for 13 years and the US Federal Reserve issued the biggest interest rate hike in 22 years. While that’s making bonds more attractive from an income point-of-view, it’s caused the global bond market to fall in recent months.

Central banks have indicated there could be more interest rate rises to come, as they’re a key tool in the battle against inflation. That wouldn’t bode well for bonds. Central bank rhetoric shouldn’t be taken at face value though. Sometimes they’ll say one thing and do another. Putting up interest rates can also harm the economy, so it’s unlikely central banks will let them loose completely as ultimately that could trigger recessions.

While the near-term outlook doesn’t look favourable for bonds, interest rates won’t keep rising forever. They’ll eventually peak and could fall back down again at some point. Rising yields will also eventually benefit investors, as they form part of bonds’ total return (along with price changes).

Bonds’ performance potential certainly looks diminished, however, compared to years gone by. Although they always tended to play second fiddle to equities in terms of driving portfolio growth, bonds may deliver even lower levels of long-term returns in the future. The amount of bonds to hold in your portfolio then really depends on how much you want to reduce the ups and downs in performance.

While recent bond falls have undoubtedly been disappointing, it’s important to remember even lower-risk investments such as bonds aren’t immune to turbulence. So just because they’ve fallen, it doesn’t necessarily signal cause for concern.

Even before recent bond declines, though, we’ve viewed some exposure to alternative types of investments such as gold as a useful portfolio addition. That means there’s not complete reliance on bonds to provide protection against stock market volatility. We think it’s also important to invest in a range of bond types, such as government, corporate and inflation-linked, as different ones work well in different conditions.

As with any investment, we think it’s far more important to focus on long-term potential rather than the short term or recent past events. While of course we can never know for certain what the future holds, we believe bonds still remain one of the best ways to reduce volatility. That’s why they continue to form a key part of our balanced and cautious portfolios. So in our view bonds have been bruised, but are not busted.

Past performance is not a guide to future returns. Investment in securities involves the risk of loss and the advice herein cannot be construed as a guarantee that future performance will be reflective of past returns.

Ordered list

Unordered list

Ordered list

Unordered list